The Greater Hot Springs Chamber of Commerce is an active leadership organization empowered by its membership to effect economic growth and community development while preserving the area's high quality of life.

Brian G. Wilson Photography

Click here to view photos taken by Brian G. Wilson Photography at the Annual Banquet.

Become a Member

The Chamber helps to create a stronger, more dynamic, and prosperous business community. As a member, your business enjoys a competitive edge with leadership opportunities, connections to business leaders, and business-building initiatives. The Chamber works to create a climate of growth and success in which all Hot Springs companies – regardless of size or industry – can prosper.

Mark Your Calendar

Cards Over Coffee

Cards Over Coffee is a morning networking event where you can make great business connections while enjoying tasty coffee and pastries.

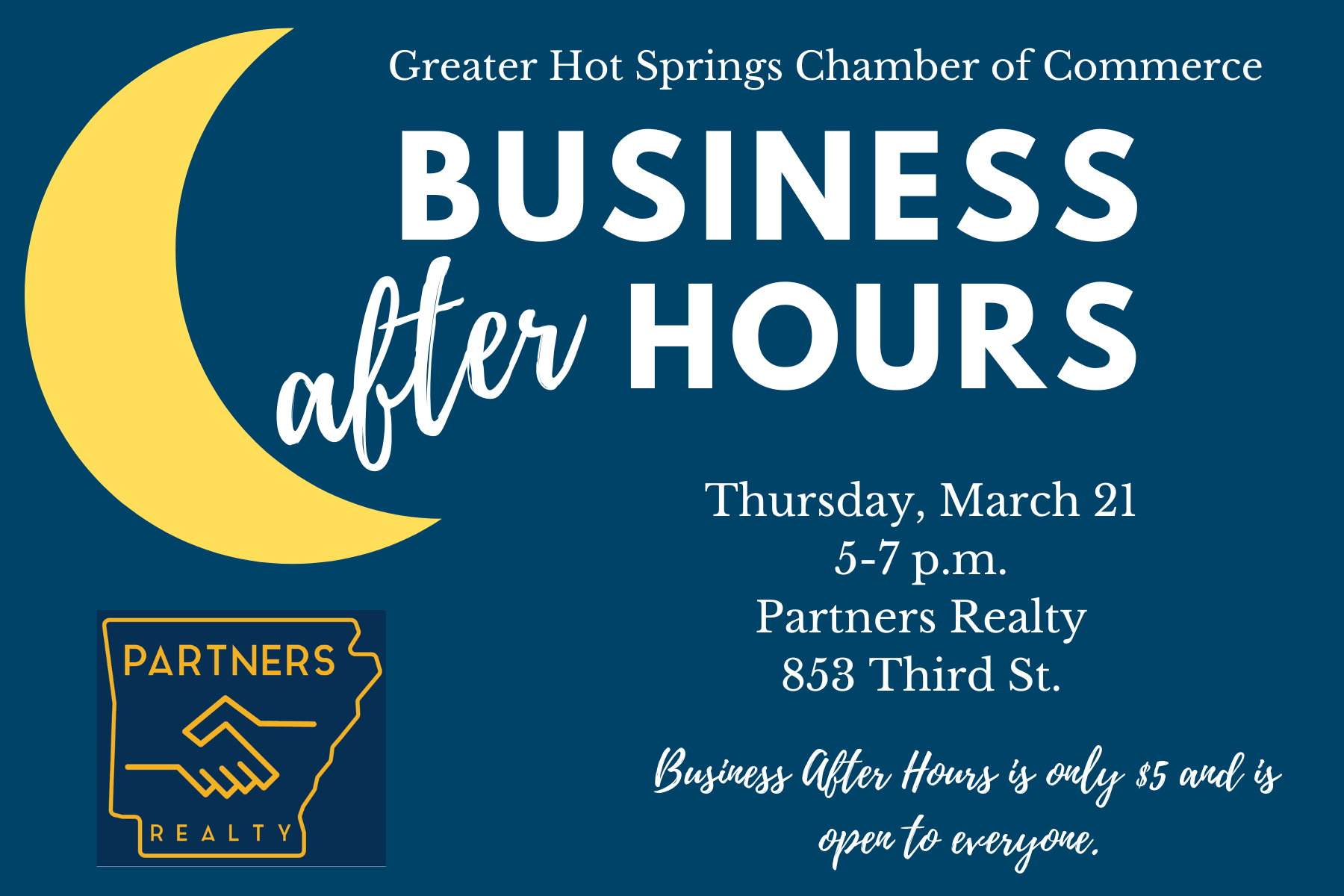

Business After Hours

Business After Hours is a laid-back and fun networking event held once a month. Make plans to attend for wonderful food and drinks while enjoying great conversation and making business connections. BAH is only $5 and is open to everyone.

Cards Over Coffee

Cards Over Coffee is a morning networking event where you can make great business connections while enjoying tasty coffee and pastries.